SOL Price Prediction: 2025-2040 Forecasts and Analysis

#SOL

- ETF approvals and institutional demand are creating immediate bullish momentum for SOL

- Technical indicators suggest consolidation near current levels with potential breakout toward $210

- Long-term growth depends on ecosystem development and broader cryptocurrency adoption trends

SOL Price Prediction

Technical Analysis: SOL Price Positioned for Breakout

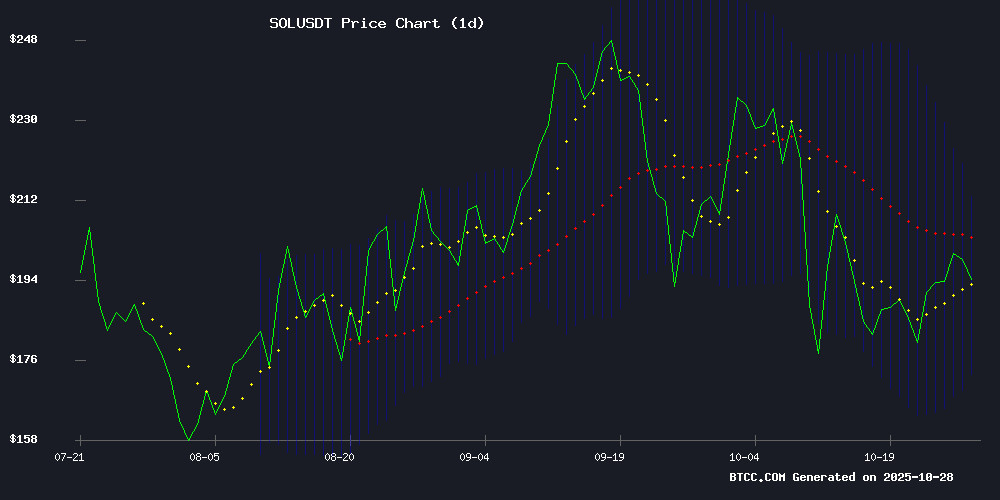

According to BTCC financial analyst Michael, SOL is currently trading at $192.13, slightly below its 20-day moving average of $192.81, indicating potential consolidation. The MACD reading of -3.70 suggests weakening momentum in the short term, though the Bollinger Bands show SOL trading NEAR the middle band with room to test the upper resistance at $212.57. Michael notes that a sustained break above the 20-day MA could trigger a move toward the $204-210 range in the coming weeks.

Market Sentiment: ETF Developments Fuel SOL Optimism

BTCC financial analyst Michael highlights that recent SOL ETF launches, including VanEck's amended filing and Bitwise's spot product, are driving institutional interest and bullish sentiment. The approval of the world's first SOL ETF in Hong Kong has created positive momentum, with price targets ranging from $200 to $250. Michael cautions that while technical indicators show short-term consolidation, the ETF narrative supports a broader upward trajectory, aligning with technical projections for a November breakout.

Factors Influencing SOL's Price

SOL Price Prediction: Targeting $204-210 Range by November 2025

Solana's technical analysis suggests a bullish trajectory, with a price target of $204-210 within the next 2-3 weeks. Key resistance stands at $229.69, while the current MACD bullish divergence reinforces upward momentum.

Trading at $200.80, SOL hovers near its pivot point of $200.46, poised for its next decisive move. Analysts from Changelly, AMB Crypto, and 30rates.com converge on a tight prediction range of $193.70-$204.51, signaling limited downside risk and measured upside potential.

Short-term targets place SOL at $204.51 within a week, with a medium-term forecast of $195-$218 over the next month. The $213.30 level remains critical for bullish continuation, while $193.25 serves as key support in case of a downturn.

Solana (SOL) Price Prediction 2025: BSOL ETF Launch Fuels Bullish Trend

Solana's SOL token trades at $203.65 amid a 2.04% daily gain as Bitwise launches the first US-regulated Solana ETF (BSOL), combining price exposure with staking rewards. The move signals growing institutional adoption, with technical indicators reinforcing bullish momentum.

RSI at 65.16 and MACD's bullish crossover suggest upward potential without overbought conditions. Trading volume hits $6.15B as Solana's blockchain advantages—speed and scalability—continue attracting capital during broader market volatility.

SOL ETF: Institutional Demand and Volatility Reshape Solana's Trajectory

Solana's market dynamics are shifting as institutional interest grows, fueled by speculation around a potential SOL ETF. The crypto now faces a critical juncture—balancing short-term volatility with long-term stability.

Technical indicators show SOL compressing within a symmetrical triangle, with key resistance levels at $220, $237, and $254. Support holds at $194-$175. Breakouts will require more than just ETF hype—network performance, TVL growth, and dApp activity must justify valuations.

Pantera Capital's analysis suggests spot ETFs could trigger initial price surges followed by steadier flows. "Index products don't invent value; they channel it," observes one market participant. The real test comes when recurring subscriptions begin.

VanEck Amends Solana ETF Filing for Auto-Approval as Bitwise Launches First Spot SOL Product

VanEck has submitted its sixth amended S-1 filing for a spot Solana ETF, revising language to enable auto-approval and maintain a 0.30% sponsor fee with waivers. The update follows Bitwise's landmark launch of the first Solana ETF on NYSE Arca today, which similarly waived fees in its final prospectus.

Regulatory filings reveal both issuers are employing near-identical strategies—leveraging 8-A filings for automatic effectiveness 20 days post-submission. This parallel approach suggests coordinated positioning among ETF providers despite SOL's 3% price dip amid the product launches.

The amended documents emphasize staking mechanics and risk disclosures, reflecting SEC scrutiny of crypto-native features. VanEck's latest filing notably mirrors Bitwise's structural choices, indicating potential standardization for future altcoin ETF applications.

Solana Price Eyes $250 as ETF Hype Fuels Bullish Reversal

Solana's price surged 14% from last week's low, buoyed by institutional demand following the launch of Bitwise's BSOL—the first U.S. spot ETF tracking SOL. The token now flirts with a breakout from a two-month falling channel, trading at $202 after tapping $204 intraday.

NYSE Arca-listed BSOL distinguishes itself with staking functionality, a feature absent in conventional spot ETFs. Exchange outflows and a 5.4% spike in trading volume to $6.38 billion signal mounting investor interest. This ETF debut could unlock long-term institutional participation, though SOL remains 20% below its September peak of $252.

Solana (SOL) Eyes $200 Breakout as World's First SOL ETF Launches in Hong Kong

Solana's SOL/USD pair is staging a robust recovery, rallying over 60% from recent lows as bulls target a decisive break above the $200 resistance level. The cryptocurrency now faces a critical juncture after two years of consolidation between $120 and $260, with technical indicators suggesting accumulating energy for a potential breakout.

Market sentiment received a significant boost with Hong Kong's landmark listing of the world's first Solana ETF, set to begin trading tomorrow. This institutional milestone comes as the network marks 21 months of uninterrupted uptime—a notable achievement for a blockchain once plagued by stability issues.

Technical charts reveal a bullish configuration, with price action holding above all key moving averages on weekly timeframes. The daily chart shows MA200 providing reliable support while MA100 poses immediate resistance. Neutral RSI readings suggest room for upward momentum should buying pressure intensify.

Solana vs BlockDAG: The 2025 Crypto Market Showdown

The crypto landscape of 2025 is witnessing a clash of ideologies as Solana's institutional appeal battles BlockDAG's grassroots momentum. Solana (SOL) has cemented its position as a favorite among traditional investors, with Fidelity's inclusion of the blockchain in its U.S. trading suite marking a significant milestone. The network's focus on real-world asset tokenization has attracted over $16 trillion in managed assets, solidifying its role in global finance.

Hong Kong's approval of a Solana ETF further validates its institutional credibility, placing it alongside Bitcoin and Ethereum as a blockchain with regulated investment vehicles. This development enhances liquidity and global visibility, drawing more capital into the ecosystem.

Meanwhile, BlockDAG (BDAG) represents a counter-narrative—a decentralized alternative gaining traction through community participation and transparency. The platform's growth underscores a growing divide in crypto's future: corporate-backed infrastructure versus democratized networks.

SOL Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and market developments, BTCC financial analyst Michael provides the following SOL price projections:

| Year | Price Range | Key Drivers |

|---|---|---|

| 2025 | $200-250 | ETF approvals, institutional adoption |

| 2030 | $400-600 | Mainstream blockchain adoption, ecosystem growth |

| 2035 | $800-1,200 | Global digital asset integration, regulatory clarity |

| 2040 | $1,500-2,500+ | Mature market position, long-term value storage |

Michael emphasizes that these projections assume continued ecosystem development and favorable regulatory conditions. Short-term volatility should be expected, but the long-term trajectory remains positive given Solana's technological advantages and growing institutional interest.